Managing Coronavirus Federal Aid

Six Coronavirus bills have been signed into law. These bills provide significant resources for citizens and state governments to deal with the Coronavirus public health emergency and the impact of the health emergency on Hawaii’s people and the economy.

-

- Coronavirus Preparedness and Response Supplemental Appropriation Act, 2020 (HR 6074; PL 116-123), signed into law on March 6, 2020;

- Families First Coronavirus Response Act, 2020 (HR 6201, P.L. 116-127), signed into law on March 18, 2020; and

- The Coronavirus Aid, Relief, and Economic Security (CARES) Act (HR 748, P.L. 116-136), signed into law on March 27, 2020.

- Paycheck Protection Program and Healthcare Enhancement Act (HR 266, P.L. 116-139), signed into law on April 24, 2020.

- Consolidated Appropriations Act, 2021 (HR 133, P.L. 116-260), signed into law on December 27, 2020.

- American Rescue Plan Act of 2021 (H.R. 1319, P.L. 117-2), signed into law on March 11, 2021.

Coronavirus federal aid is being made available in three ways:

-

- By disbursement to individuals, businesses and non-profits:

The State of Hawaii has a limited role with this method of aid disbursement. - By changes to certain criteria of state-run federal programs:

Most Coronavirus Federal Aid will be provided to the state and individuals through changes to federal program criteria such as changes to eligibility requirements, cost-share, or providing access to federally administered programs. - By award from a federal funding agency to a state department as either a new federal award or a supplement to an existing award.

- By disbursement to individuals, businesses and non-profits:

The following additional actions are being taken to manage COVID-19 awards for state departments:

-

- B&F is identifying Coronavirus federal aid appropriated for Hawaii in the six federal bills and the state recipient department using FFIS (Federal Funds Information for States) and other information sources.

- B&F is contacting recipient departments to make sure they are aware of the funding opportunities and are taking necessary actions to receive the enhanced aid.

- Receipt of each award notice is recorded by the prime recipient in the State’s DataMart/Federal Award Management System (FAMS) and reviewed by B&F.

- B&F is rushing approvals to expedite the posting of the federal funds in the award’s appropriation account so that expenditures can be made by the state program as quickly as possible. Finance Memorandum No. 20-07, Expedited Processing of COVID-19 Funds has been issued to all State departments with instructions on steps to take to expedite approvals.

- B&F is maintaining a report of the COVID-19 awards appropriated for the State of Hawaii and awards received by State departments and will update below reports as new information is made available.

COVID-19 AWARDS APPROPRIATED TO HAWAII (Updated August 6, 2024)

This report lists funding for resources to deal with the Coronavirus Pandemic that have been allocated to Hawaii in the five coronavirus bills.

COVID-19 AWARDS RECEIVED BY HAWAII STATE DEPARTMENTS (Updated March 31, 2025)

This report lists awards that have been awarded to Hawaii State Departments to date as appropriated in the five coronavirus bills.

REPORTS TO THE LEGISLATURE ON THE USE OF COVID19 FUNDS

Report to the Legislature on Coronavirus State Fiscal Recovery Fund (January 18, 2022)

FOLLOWING ARE AMOUNTS THAT HAVE BEEN PAID-OUT TO INDIVIDUALS, BUSINESSES AND HEALTHCARE PROVIDERS IN HAWAII AS APPROPRIATED IN THE SIX CORONAVIRUS BILLS.

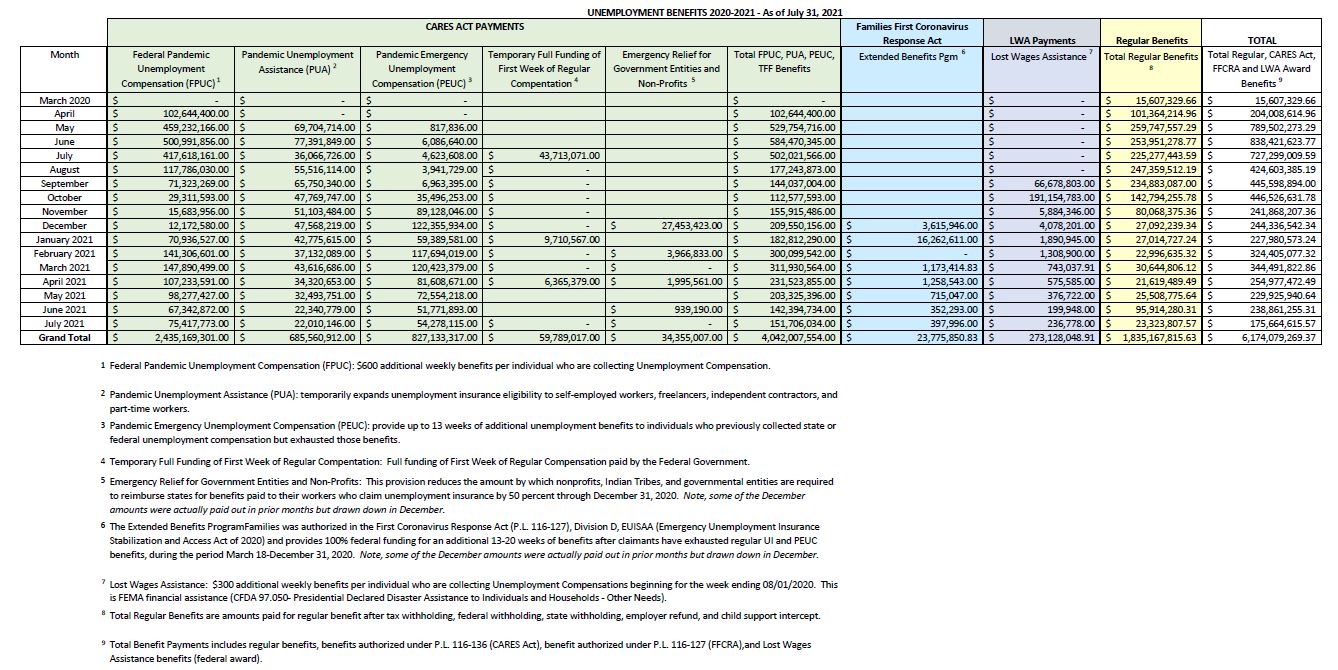

UNEMPLOYMENT BENEFITS

(As of June 18, 2021)

The Unemployment Trust Fund (UTF): State Insolvency and Federal Loans to States

Due to the impact of the COVID-19 public health emergency, states may have insufficient funds to pay for unemployment compensation benefits. Federal law, which requires states to pay these benefits, provides a loan mechanism within the unemployment trust fund framework that an insolvent state may opt to use to meet its unemployment benefit payment obligations. States must pay back these loans. If the loans are not paid back quickly, states may face interest charges and the states’ employers may face increased rates until the loans are repaid. For more information on this program can be found here.

SNAP¹ Benefits- Emergency Allotments²

As of November 13, 2020:

Month Enter on EBT Card Amount No. of Households

May 2020 $29,087,729 127,622

June 2020 $13,969,699 64,495

July 2020 $13,670,908 63,805

August 2020 $13,507,047 63,273

September 2020 $14,288,334 64,339

October 2020 $14,700,023 65,141

November 2020 $15,628,021 67,990

$114,851,761 516,665

1 SNAP = Supplementary Nutrition Assistance Program

2 Authorized by The Families First Coronavirus Response Act of 2020

SNAP BENEFITS – P-EBT 1

As of October 09, 2020:

SNAP Households Non-SNAP Households

Number of Students: 95,810 Number of Students: 95,707

Number of families: 54,670 Number of families: 62,288

Benefit amount: $30,454,938 Benefit amount: $30,733,550

1 The Families First Coronavirus Response Act of 2020 provides the Secretary of Agriculture authority to approve state agency plans for temporary emergency standards of eligibility and levels of benefits under the Food and Nutrition Act of 2008. Children who would receive free or reduced-price meals under the Richard B. Russell National School Lunch Act if not for the school closure are eligible under this provision.

U.S. Small Business Administration (SBA) Paycheck Protection Program (PPP)

Total Approvals to Date (both rounds of PPP funding and cancellations) (2020):

Hawaii approvals as of August 08, 2020:

Approved Loans: 25,097 Approved Amount: $2,478,864,703

Total Approvals (2021):

Hawaii approvals as of May 31, 2021:

Approved Loans: 20,002 Approved Amount: $1,362,722,476

U.S. Treasury, IRS Economic Impact Payments

Hawaii -Calendar Year 2020- First Round Economic Impact Payments:

Number of EIP Payments: 730,144 Total Amount of EIP Payments: $1,232,420,000

Hawaii- Second Round Economic Impact Payments:

Number of EIP Payments: 656,823 Total Amount of EIP Payments: $635,560,000

Hawaii-Calendar Year 2021- Third Round Economic Impact Payments:

Number of EIP Payments: 725,758 Total Amount of EIP Payments: $1,741,534,000

First Round EIPS:

“The Coronavirus Aid, Relief, and Economic Security Act”, also known as the CARES Act, was enacted in March 2020 and created a refundable tax credit for individuals. Section 2201(a) of the Coronavirus Aid, Relief, and Economic Security Act (CARES Act), Public Law 116-136, 134 Stat. 281 (March 27, 2020) added section 6428 to the Internal Revenue Code (Code). Section 6428(a) provides an eligible individual for their first taxable year beginning in 2020 a refundable tax credit of up to $1,200 ($2,400 for eligible individuals filing a joint tax return), plus $500 per qualifying child of the eligible individual.

The advance payment of this “2020 recovery rebate for individuals” is referred to as the first round of economic impact payments, “First Round EIP”.

Second Round EIPS:

“Coronavirus Response and Relief Supplemental Appropriations Act, 2021” legislation, enacted as Division M of the Consolidated Appropriations Act, 2021, Public Law 116-260, (December 27, 2020) created an additional refundable tax credit for individuals and added section 6428A to the Code. This legislation created an “additional 2020 recovery rebate for individuals.”

The IRS refers to the advance refund of this credit as a “Second Round EIP.”

Third Round EIPS:

“The American Rescue Plan Act of 2021 (Section 9601(a)), Public Law 117-2, (March 11, 2021) , added section 6428B to the Internal Revenue Code (Code). Section 6428B provides an eligible individual for their first taxable year beginning in 2021 a refundable tax credit of up to $1,400 ($2,800 for eligible individuals filing a joint tax return), plus $1,400 per qualifying dependent of the eligible individual(s). This tax credit is referred to in section 6428B as a “2021 recovery rebate to individuals.”

The IRS refers to the advance refund of this credit as a “Third Round EIP.”

Aviation Payroll Support Program

Under the Payroll Support Program (PSP) authorized by the CARES Act, Consolidated Appropriations Act of 2021, and the American Rescue Plan Act, the Treasury Department awarded $59 billion in financial assistance (PSP1, PSP2, and PSP3, respectively) to the domestic aviation industry for the continued payment of employee wages, salaries, and benefits.

Hawaii as of August 17, 2023:

Hawaii Passenger Carriers Participants:

Payroll Support: Total Participants: 7 Total Amount: $307,415,768

Hawaii Cargo Airlines Participants:

Payroll Support: Total Participants: 2 Total Amount: $15,842,965

Hawaii Contractor Participants:

Payroll Support: Total Participants: 1 Total Amount: $34,495

State of Hawaii Resources

-

-

- Coronavirus Relief Fund Award- Subrecipient Guide (Prepared by the Department of the Attorney General)

The Coronavirus Relief Fund (CRF) was established through the CARES Act as payments to State, Local, and Tribal governments to navigate the impact of the COVID-19 outbreak. Hawaii has received $1.25 billion in CRF funding, with the Office of the Governor and the City and County of Honolulu as “Prime Recipients.” All entities – e.g. state departments and agencies – that receive CRF awards from the Prime Recipients are “Sub-Recipients” of CRF. This Guide – prepared by the Department of Attorney General and the Department of Budget & Finance – is designed to assist Sub-Recipients of CRF funds allocated to the Office of the Governor in complying with key legal and regulatory requirements associated with the management and use of CRF funds. It explains eligibility and reporting requirements, as well as oversight and accountability framework.

- Coronavirus Relief Fund Award- Subrecipient Guide (Prepared by the Department of the Attorney General)

-

State of Hawaii Memorandums

EM 24-03: Management of Non-Appropriated Coronavirus State Fiscal Recovery Funds for FY 25

EM 24-03 CSFRF-1 Request for Use of Coronavirus State Fiscal Recovery Funds for FY25 (July 2024)

EM 23-04: Management of Non-Appropriated Coronavirus State Fiscal Recovery Funds for FY24

EM 23-04 CSFRF-1 Request for Use of Coronavirus State Fiscal Recovery Funds (June 2023)

EM 23-04 CSFRF-2 Attestation of Qualifying Coronavirus State Fiscal Recovery Funds Expenditures (Revised August 2023)

EM 22-02 CSFRF-1 Request for Use of Coronavirus State Fiscal Recovery Funds (June 2022)

EM 22-02 CSFRF-2 Attestation of Qualifying Coronavirus State Fiscal Recovery Funds Expenditures

FM 22-03: Close-Out Procedures for Coronavirus State Fiscal Recovery Funds (CSFRF)Subawards

FM 22-03 CSFRF-3 Request for No Cost Extension (NCE)

EM 21-03: Management of Appropriated and Non-Appropriated Coronavirus State Fiscal Recovery Funds

EM 21-03 CSFRF-1 (v3) Request for Use of Coronavirus State Fiscal Recovery Funds

FM 21-04: Close-Out Procedures for Coronavirus Relief Fund (CFR) Subawards

EM 20-06: Update on Management of the Coronavirus Relief Fund Award

EM 20-04: Management of the Coronavirus Relief Fund

FM 20-07: Expedited Processing of COVID19 Federal Funds

PC 20-11: “Guidance: Contractor Responsibility Guidance During COVID-19 Crisis”

CM 20-15 Reporting of Data on COVID-19 Activity

Establishment of New Revenue Source Code 0583 (Federal COVID19 Funds)

How Long do COVID-19 Pandemic Records Need to Be Kept?

Comptrollers Memorandum: 2020 Compliance Supplement Addendum 2 CFR Part 200, Appendix XI, Compliance Supplement Addendum

Federal Memorandums

GAO-20-625: COVID19 Opportunities to Improve Federal Response and Recovery Efforts

CRS- Resources for Tracking Federal COVID-10 Spending (June 1, 2021)

Federal Reports